Passive income is the most sought after thing by everyone, on average they want to get more money than usual. But not all can get passive income, maybe they are constrained by very busy working hours or do not have the ability. The world is growing, and the world of technology is also growing, even blockchain technology has developed very rapidly in the last 5 years. Starting from 2 years ago, DEFI blockchain has arrived, and is booming until now, people can make a lot of money or passive income from DEFI blockchain projects.

DEFI stands for “Decentralized Finance”, this is a financial application or Dapps that is on the blockchain, defi was built to facilitate financial management and speed up the transaction process and very high security, because defi runs on the blockchain, all data will be recorded on the blockchain and not can be manipulated. DEFI has many types, and we will summarize them below:

- Lending Platform : Cryptocurrencies that are tied to assets outside of cryptocurrencies (dollars or euros, for example) to stabilize prices. this is usually used for borrowing or lending USD stable coins by pledging coin assets such as ETH.

- Yield Farming : Project defi yield farming is one that is still popular today, you can stake coins or tokens on certain platforms to get a lot of results or returns. The amount or results obtained depend on the developer who created the defi project. This is the platform that I like the most, because we can get passive income without spending a lot of time

- Staking : The flow is, you stake a token with a certain amount, and lock it for a certain time, after that you will get a return according to the annual APR amount and the percentage amount of tokens you stake .

- Liquidity Pools : To participate on this platform, you need to enter two tokens into the liquidity pool, for example the coin pair CET and ONE, after you enter these two tokens, you will automatically earn from transaction fees on the DEX exchange,

In this article, we will provide a tutorial on how to get passive income from the Coinex Smart Chain Staking and Farming platform. You can generate passive income easily without spending time, and you can try it with not too much amount or capital.

1. Passive Income from Staking Coin CET (Coinex Smart Chain)

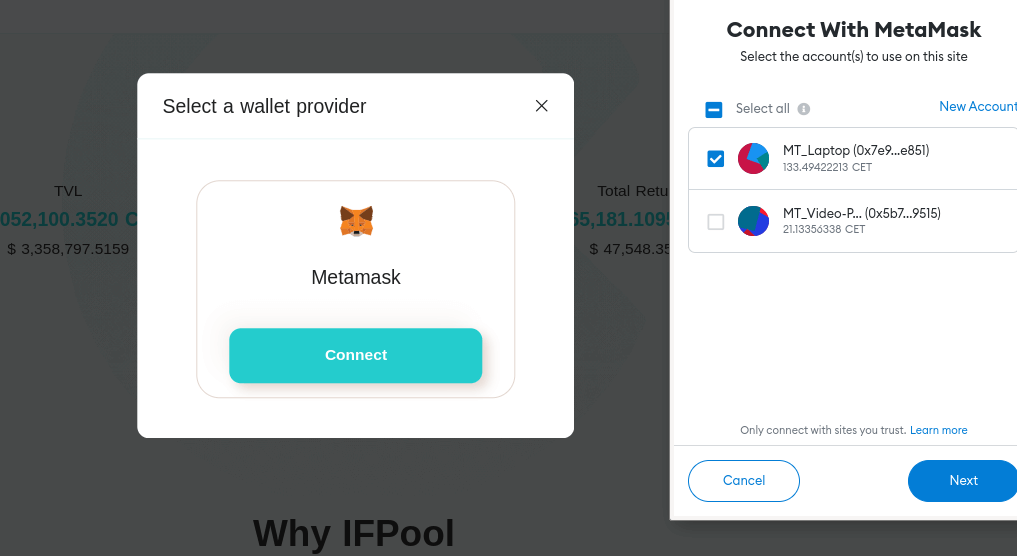

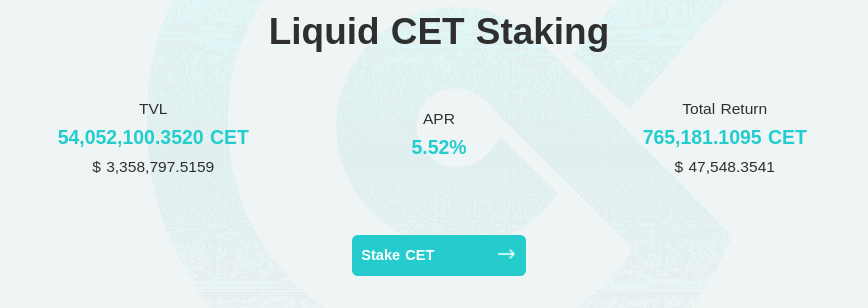

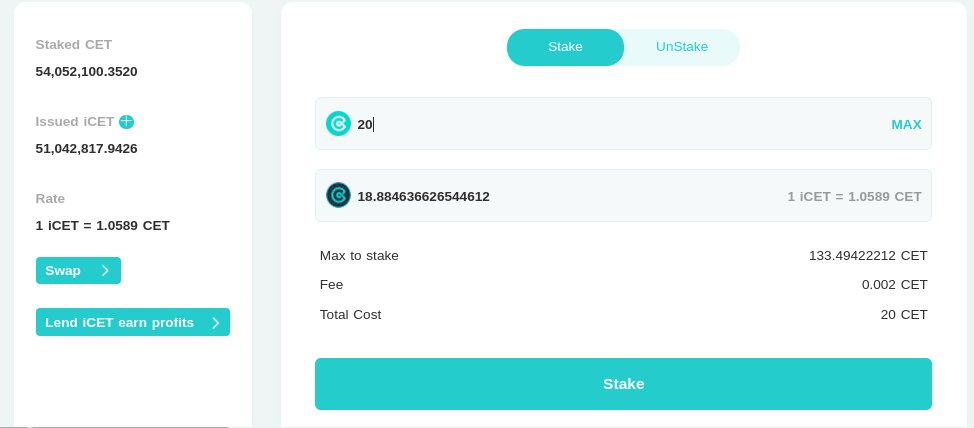

To staking on the coinex smart chain ecosystem, you need an “EVM Wallet”, you can use metamask, and a native coinex smart chain (CET). Once your wallet is filled with CET, you can start making money (in CET coins) on the ifpool (CSC staking pool) platform. the amount or staking income depends on the amount of APY and the amount of your coins, for now ifpool gives a return of around 5.52%, this amount may change according to their discretion

Start staking CET to get passive income

# Visit ifpool.io & “Connect Wallet”

# Klik “Stake CET”

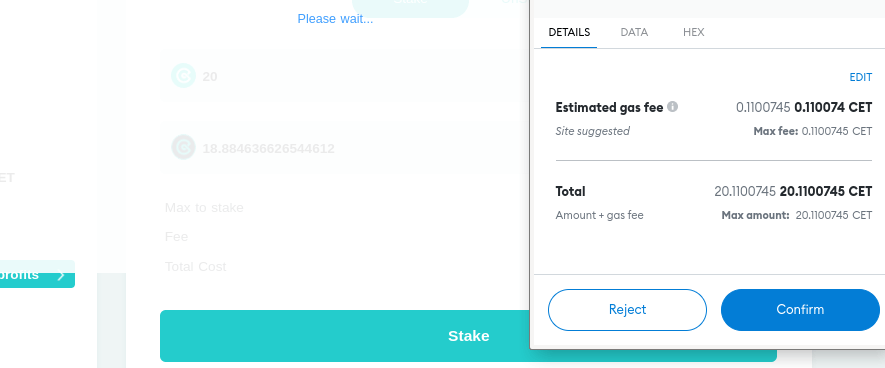

# Enter the amount of coin “CET” you want to stake, and click the “Stake” button, and confirm the transaction in the wallet by clicking the “Confirm” button

# Staking Completed, you just have to wait and start earning CET coins every day. To get big results, you need to stake a large amount of CET coins too,

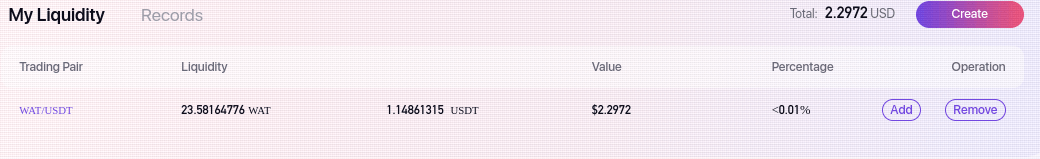

2. Passive Income Dari Liquidity Pools

To get passive income you need to enter two currencies or tokens into the pool, after you enter the pool, you will get income from transaction fees on the DEX platform (||Decentralized Exchange). You can use the oneswap pool platform, “oneswap” is the first DEX platform in the coinex smart chain ecosystem.

# Visit oneswap.net & “Connect Wallet”

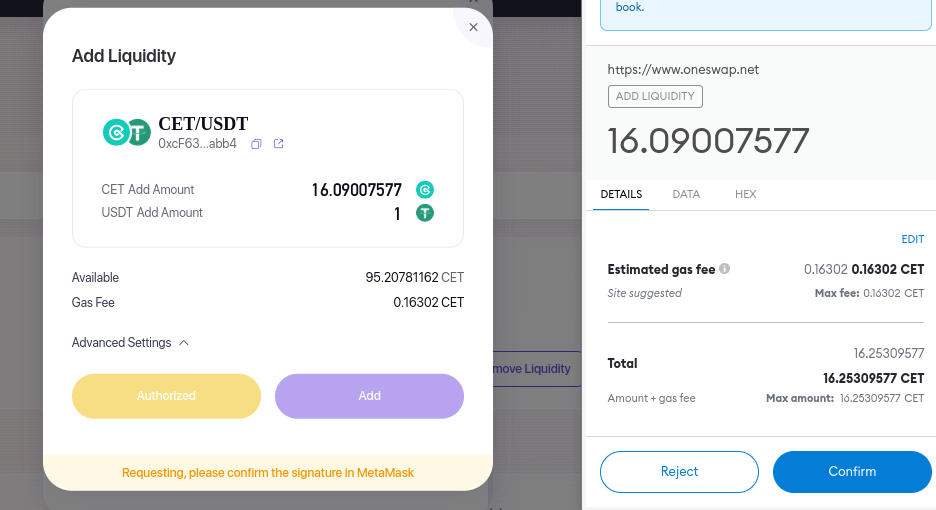

# Think first, what coin pair you will use, our example uses the CET/USD pair, so we need the same amount of USDT and CET tokens, for example 1 USDT and CET (with a value of 1 usd too)

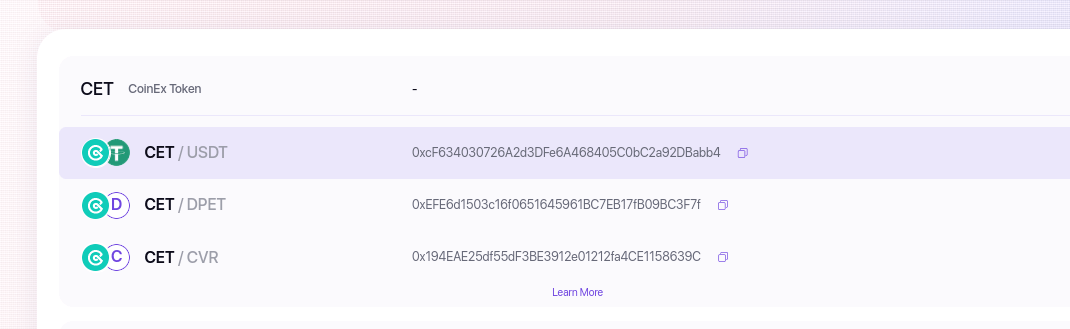

# Click the “Pool” menu, enter the search field, and search for the currency pair you want to use

# Click “Add Liquidity” and enter the amount you want + click “add” and confirm on the wallet “Confirm”

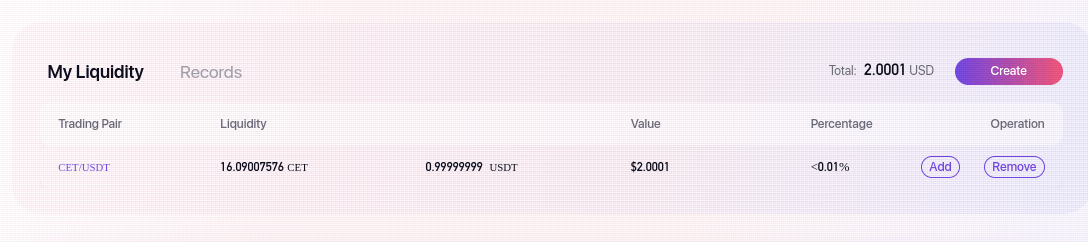

# Add Liqudity finished, it will appear in the “Pool” menu, you just need to wait, every time there is a transaction on the currency pair, you will get a fee or income

3. Passive Income From Platform Lending

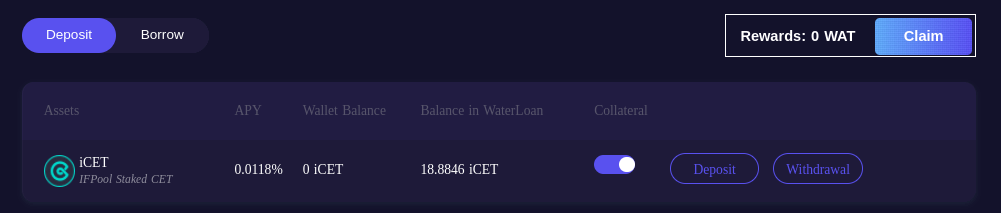

The system is, you lend coins or tokens to the lending platform, then you will get passive income based on the amount of APY and the amount of your deposit, the bigger your deposit, the bigger your income will be. To get income from the lending platform, you can use “Waterloan Finance”.

# Go to waterloan.finance and “connect your wallet”

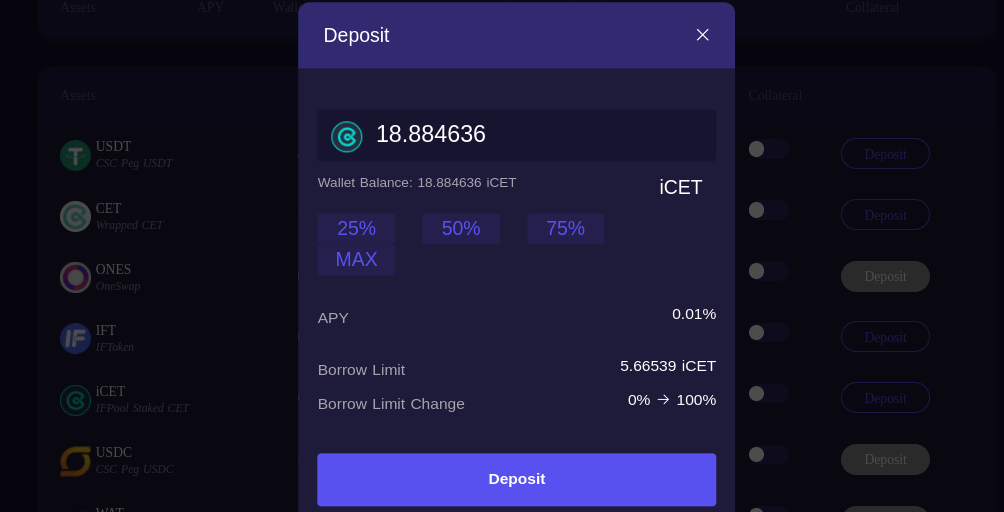

# Go to the “Dasboard” menu and select the coin or token you want to use, * our example uses iCET tokens for deposits. Click the “Deposit” button and enter the number of tokens that you input into the lending platform, and confirm “Confirm” on your wallet

# Lending Done, you will get passive income in the form of WAT tokens, WAT tokens are tokens belonging to the waterloan lending platform

3. Passive Income from Yield Farming

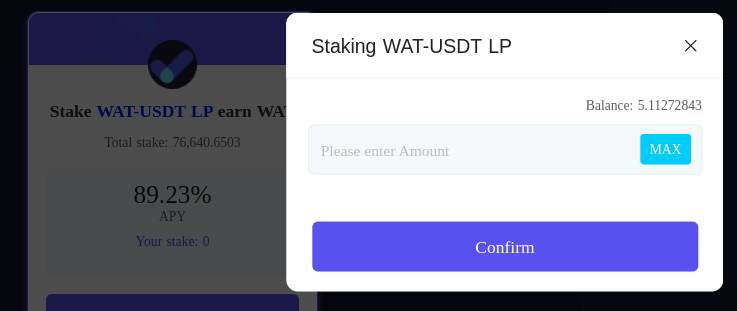

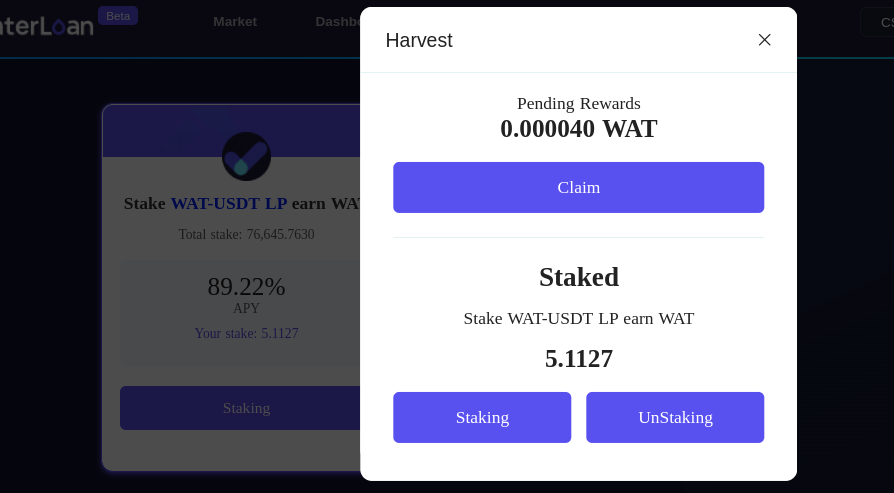

When you enter 2 tokens into the Liquidity Pool, you will get a Liquidity Provider Token, these tokens are tokens that you can use to farm on the “Yield Farming” platform. in this article I use the waterloan finance platform, I will enter the liquidity provider token from the WAT-USDT pair.

# Provide 2 tokens for liquidity pool, example WAT-USDT. Go to oneswap.net and enter the 2 tokens into the pool

# Visit waterloan.finance, enter the “Liquidity Mining” menu, select Farming WAT-USDT LP. Click the “Stake” button

# Enter the number of tokens WAT-USDT LP , and click the button “Confirm” on wallet

# Farming Done, after the stake-farming process is complete, you start to get passive income in the form of WAT tokens, the amount of income depends on your APY and the amount of your LP deposit

Good luck